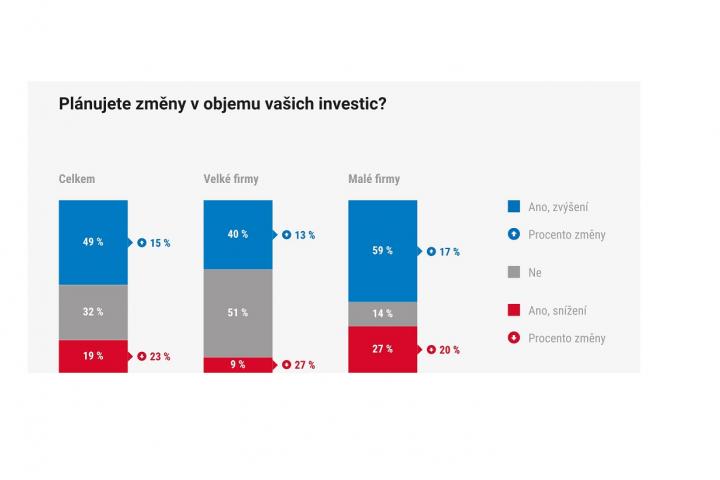

Half of manufacturing firms (49%) will invest more in new technologies in the coming year, with an average increase of 15%. Despite an unfavourable period when costs are rising rapidly for manufacturing firms and most of them (65%) expect their profitability to decrease this year, CEOs are aware of the necessity of investment as a prerequisite for their company's survival in the ever-increasing global competition.

Digital technologies are helping companies to overcome global crises. In practice, the ability to communicate with customers remotely, technologies to monitor and optimise energy consumption and tools to streamline warehouses and production areas have proved most useful. Currently, companies see the biggest benefits in the use of big data analytics, 3D printing and the deployment of robots in production.

"We are on the brink of arguably one of the most significant and massive crises we have seen globally in decades. Already the covid-19 pandemic, which started the road to this crisis, has shown that the winner of this period is digitalisation. It is one of the tools that can mitigate the impact of crises," says Jaroslav Liskovec, director of the National Centre for Industry 4.0, adding: "For digitisation to be an increasingly powerful tool, it is necessary to massively support science, research and innovation. Countries that understand this will even have a chance to emerge from the crisis years stronger and more competitive."

These turbulent times caused the extent to which manufacturing firms will invest in innovation this year varies widely. Despite all the cash-flow issues, most CEOs recognise the importance of investment to improve their company's competitiveness and half (49%) confirmed that they will increase their investment this year, by an average of 15%.

In particular, small and medium-sized enterprises (59%) are planning to invest more, compared to two-fifths (40%) of large companies. At the same time, the SME segment is more volatile in its investments than the large company segment, with a quarter of small companies (27%) planning to invest less this year. On average, they will reduce their investments by 20%. Large companies, on the other hand, are stable in their investments, with half of them (51%) keeping their spending on new technologies at the same level as a year ago.

"Rising prices of energy, materials and other inputs may cause companies to postpone or cancel planned investments. It is important to remember that investment in digitalisation means higher productivity, higher added value, greater flexibility and resilience. Thanks to digitalization, significant savings can be achieved in production input costs, whose current growth means a shorter payback period for such investments," says Eduard Palíšek, CEO of Siemens Czech Republic.

"Investments that make sense and have a clear return need to be made at all times. The most successful companies invest the most in times of crisis, which gives them an edge over their competitors in the form of better technology, more modern equipment or more efficient production processes. Of course, if investments are financed by banks, high interest rates can be a problem, as we are witnessing now. But there are other ways of securing the resources to finance investment. For example, by bringing in an investor, whether private or through the stock exchange," says Jaroslav Řasa, owner of ABRA Software, the Czech leader in the digital software market, giving advice to companies in a difficult situation.

Jaroslav Hanák, President of the Confederation of Industry of the Czech Republic, points to the fact that companies that invest in new technologies cope better with crises: "Our long experience confirms that investments in innovation, digital technologies or energy savings, for example, pay off for companies. They get ahead of the competition and are more productive and actually more resilient. But the rapid pace of price increases is likely to limit investment activity."

The practice of manufacturing companies proves this. First the pandemic and then the war crisis shook up the world order, and companies had to react quickly, from one day to the next, according to the current situation. If they had more digitised production, they could make faster and more calculated decisions, change the production programme or the overall company structure more flexibly. Industry 4.0 technologies allowed them to work remotely - without losing the necessary contact with the customer.

Jaroslav Řasa describes the complexity of the new situation and the role of Industry 4.0: "Many industries have so far relied on otherwise very efficient production and just-in-time logistics with the need to maintain minimal reserves. But such an approach assumes that the world behaves predictably. However, extraordinary events have brought about a completely new situation. Both Covid-19 and the war in Ukraine have fundamentally constrained entire supply chains."

"Digitalisation gives companies a crucial competitive advantage: flexibility. A digitised supply chain allows companies to react quickly to supply shortages, price changes or transport availability. Thanks to digitised production, product parameters can be quickly changed or individualised, and digitised product development significantly reduces time to market. If necessary, digital technologies also allow the entire production programme to be reconfigured more quickly," adds Eduard Palíšek.

According to the survey conducted by the National Centre for Industry 4.0, CEOs consider the greatest benefits that new technologies have brought them in times of crisis to be the increased ability to communicate with their customers remotely, e.g. through virtual reality or the interconnectivity of digital systems - they gave this area 8.4 points on a scale of 0 min to 10 max.

"Yes, digital technologies have helped us in the crisis. Especially the strengthening of data lines and IT infrastructure. More remote working," confirms Jiří Vystrčil, Plant Manager, THK RHYTHM AUTOMOTIVE CZECH a.s.

New technologies also significantly help manufacturing companies to better monitor and optimise energy consumption and to streamline the layout of warehouses and production areas (identical 7.3 points). In particular, manufacturers of machines and machinery systems appreciate the increased competitive advantage enabled by the deployment of digital technologies in the provision of remote services - typically maintenance capabilities (6.3 points).

Eduard Palíšek explains how digitising production can bring significant energy savings: 'For example, with digitally optimised production processes, data analysis and virtual commissioning, and innovative integrated drive technologies, energy savings of up to 40% can be achieved. Significant reductions in energy consumption can also be achieved by implementing cloud-based solutions such as MindSphere. These provide valuable insights into consumption patterns, demand and expenditure, and smart energy management can reduce consumption by up to 20%."

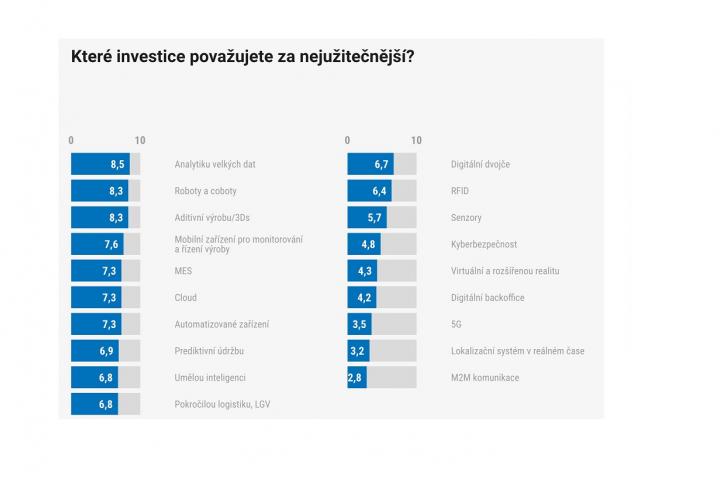

In terms of specific Industry 4.0 technologies, companies currently see the greatest benefit in the use of big data analytics (8.5 points), 3D printing (8.3 points) and the deployment of robots or cobots in production (8.3 points).

Mobile devices for monitoring and controlling production (7.6 points) and the installation of automated equipment (7.3 points) are also proving useful to manufacturing companies in practice. MES systems (7.3 points), cost-saving predictive maintenance (6.9 points) and advanced logistics (6.8 points) are certainly contributing to more efficient company operations. Artificial intelligence (6.8 points) and the digital twin concept (6.7 points) are effectively helping in many areas of company operations (6.8 points).

"In the crisis, companies were trying to solve the lack of experts in production by remote access and remote assistance and encountered problems with the unavailability of quality and fast connections. Another example is the effort to automate routine tasks and replace the missing workforce, here the problem was how to identify and quickly implement these tasks. Nowadays, we already observe that most companies are trying to look at digitalisation in a comprehensive way and are preparing their own strategy for digitalising production. This is also related to the plan to use the right telecommunication technologies, such as private 5G mobile networks," Luboš Lukasík, Director of the Corporate Customer Segment at T-Mobile, describes the market situation.

Jiří Bavor, Director of Automation at ATOS, also shares his experience from his clients, "Many companies are already collecting and using production data much more and I think the biggest area where we are seeing very real results is knowledge of the actual state of production based on real data - not manual XLS reports - and actually increasing the yield and availability of production equipment and therefore production efficiency. And then the other big area is the use of digital twins and models and simulation in the development of new products and their manufacturing technologies."

Further information on the topic can be found in the Czech Industry Analysis 2/2020, to be presented by the National Industry Centre at the National Industry Summit 2022 on 10 June Journalists are cordially invited to register at alena.novakova@cvut.cz.