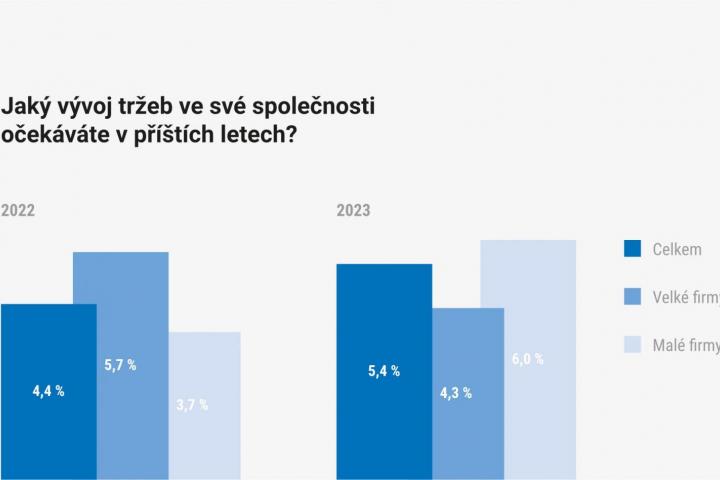

Sales of industrial companies will increase by an average of 4.4% next year. However, forecasts of CEOs differ significantly. Most firms (18%) expect their sales to grow by 8-10%. In contrast, 5% of industrial companies’ CEOs are concerned about a significant 18-20% decline in their sales. One-tenth of the CEOs (12%) are resigned to their company's stagnation for the next year in terms of revenue from products sold.

CEOs of large companies are particularly optimistic, expecting sales to be two percentage points higher than those of SMEs (5.7% vs. 3.7%). The positive growth trend is expected to continue in 2023, when CEOs expect their firms' sales to increase by an average of 5.4%. CEOs of SMEs also anticipate a more significant increase in sales, looking forward to 6% growth, compared to large firms, which expect a slower growth pace by two percentage points (4.3%).

"According to companies, the absolute biggest hurdle for Czech businesses is the lack of workforce. In the short and medium term, a more liberal policy of importing foreign workers could bring some boost to businesses. In the long term, the only solution in an ageing country will be substantial investment in automation and robotics in industry and some services," says Jiří Rusnok, Governor of the Czech National Bank. "The biggest obstacles to companies' economic development now are the rising prices of input materials and semi-finished goods and the rising cost of energy. Companies do not expect this to improve next year either. Some of them have been helped by the fixing of energy prices, others havefocused on cost-cutting. In the medium and long term, however, the only solution will be an emphasis on added value, digitization and innovation," says Petr Jonák, Head of Corporate Affairs & Sustainability, T-Mobile Czech Republic a.s.

Vladimír Mařík, Vice-Chairman of the Czech Research, Development and Innovation Council and Scientific Director of the Czech Institute of Informatics, Robotics and Cybernetics of Czech Technical University, summarizes the advantages of Industry 4.0 for turbulent times like the current one: "Industry 4.0 allows to dynamically change production according to the current availability of semi-finished products and raw materials, helps to optimally compensate for logistical failures, replaces employees in the field of physical work."

"Digitization fundamentally increases the overall resilience of a company. Primarily, in the field of security, where companies are better protected against cyber threats and subsequent tangible losses. But also from the perspective of economic resilience - automation of processes, artificial intelligence and the use of big data all enable companies to better predict impending threats (for example, the imminent rise in the price of materials or shortages of parts) and to optimize current resources - employees and their productivity,as well as materials," explains Luboš Lukasík, Chief Commercial Officer Enterprise, T-Mobile Czech Republic a.s.

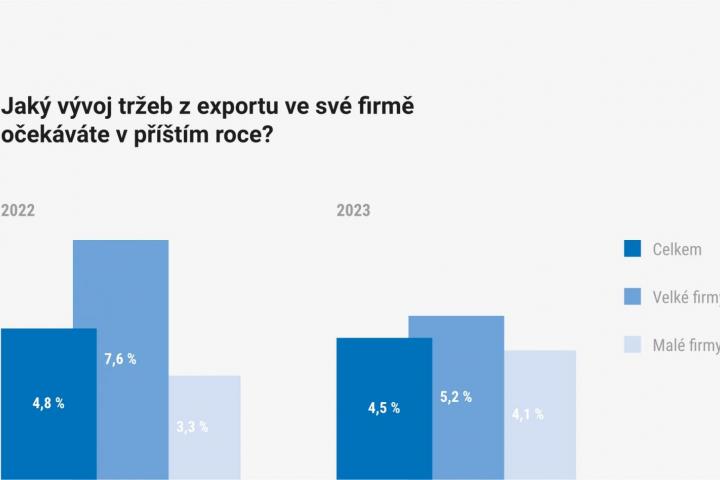

Along with growth in sales, industrial companies will also see their sales to foreign countries grow by an average of 4.8% next year. Export sales are likely to be more significant for large firms, which expect this indicator to more than double compared to small and medium-sized firms (average growth in export sales of 7.6% for large firms vs. 3.3% for small and medium-sized enterprises). Growth in export sales will continue in 2023 (the expected average increase is 4.5%) and the differences between forecasts of CEOs of large and small firms for next year are significantly smaller - one percentage point only.

"In terms of contracts, the company has met the target. Shortfalls on the part of suppliers are mainly reflected in the need for constant adjustments to the production plan in order to manufacture the products that are covered by complete inputs. Nevertheless, in terms of sales, we are meeting this year's plan. Profitability is negatively affected by rising energy, input material and parts prices. We try to reflect the rising input prices in our sales prices, but there is a time lag between the two influences," Kamil Košt'ál, Marketing Director, TATRA TRUCKS, a. s.,

describes the situation in his company.

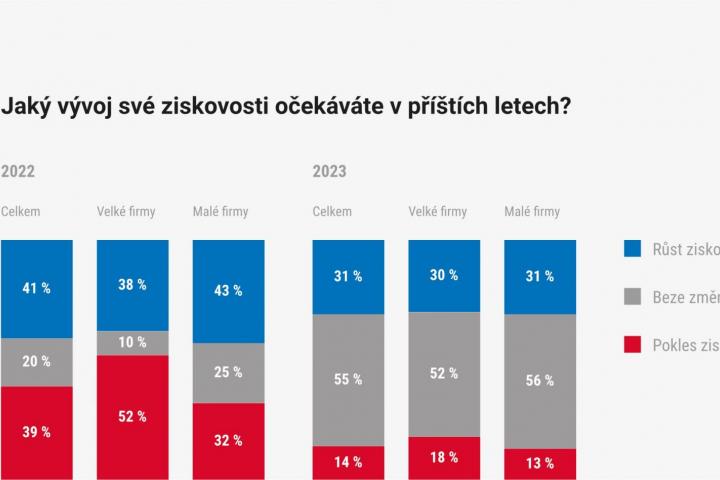

The exorbitant growth in the prices of almost all inputs of industrial production (from materials and commodities, subcontracting, energies and the cost of human labor to the rise in the price of money) has necessarily been reflected in the expected profitability that industrial firms are able to achieve next year. Manufacturing firms often find themselves in a situation where, although their sales are rising, their profitability is falling.

"In terms of sales and number of contracts - the best situation since 2009. Unfortunately, material and transport prices are reducing profitability. Satisfying the customer at any cost means reducing your margins. Current problems: lack of employees (not only qualified ones), long delivery times, rising prices of materials, services, energy, transport, exchange rate of the Czech crown," Martin Čadan, product manager FMC, Proxy, AGRO - HYTOS, s. r. o., describes key factors.

41% of industrial companies will be able to boast profitability growth next year. Unfortunately, the same proportion (39%) fear the opposite. For large corporations, which often have longer-term contracts than small and medium-sized firms, this ratio is even more alarming. Half (55%) of them expect a decline in their profitability.

"Profitability will clearly be most affected by the prices of input materials and the willingness of customers to accept the necessary increase in product prices, or the risk of competition from regions with lower costs," predicts Jiří Havránek, Chairman of the Board of Directors, KOVOPLAST Chlumec nad Cidlinou, a.s.

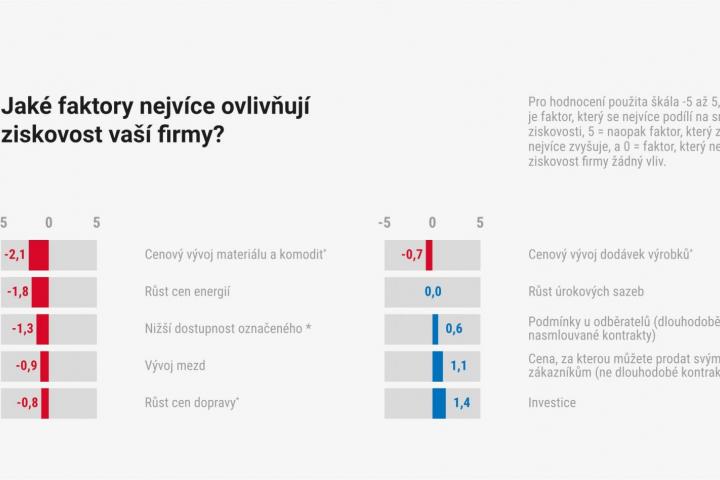

Due to the urgency of the topic, we discussed with CEOs the most significant factors that affect the profitability of their company. The price development of materials and commodities is clearly the most important factor in reducing profits, and it causes considerable difficulties for large companies in particular. Companies are also afflicted by rising energy prices and disruptions in the supply, distribution and logistics chains. The situation will of course depend on the trend in labor prices and the availability of skilled workforce.

"High energy prices could virtually wipe out the profitability of some operations, including development investments, in the coming years. Therefore, priority will be given to steps leading to local energy supply, such as photovoltaics, cogeneration sources and other energy solutions. Smart production and minimization of energy inputs in production processes supported by digital tools may be a suitable alternative. We are reaching a point where energy management will be an important part of the production process. Given the complexity of the energy and manufacturing nexus, digitization will also penetrate these areas," explains Miroslav Lopour, Strategic Project Manager for Energy, Deloitte.

On the other hand, the most significant contribution to boostingprofitability- apart from the price increases that companies manage to enforce - is the investment made. Once again, it has been proved that only a firm that can invest prudently and modify its production to achieve higher efficiency, flexibility of management and/or product innovation can succeed in the new phase of industrial transformation.

"The biggest role will be played by innovation and the ability to make products that the competition cannot produce," Jindřich Kvarda, Managing Director, Swoboda - Stamping, s. r. o., thinks innovatively.

"Naturally, digitization and P4.0 can help a lot to improve planning, increase production efficiency and, to a certain degree, replace people in some professions," says Jiří Bavor, Head of Manufacturing SEE, Atos IT Solutions and Services, s. r. o.

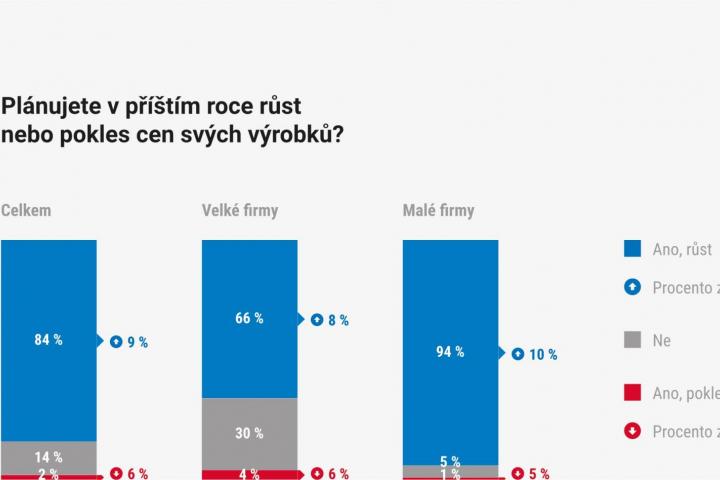

The logical impact of shortages and delays in inputs for production is price increases. Inflationary pressures are observable throughout the entire supply and demand chain. It is only a question of what the signed contracts permit. Where there is room, companies try to increase the price of their production. Unsurprisingly, this trend was acknowledged by the vast majority of CEOs (84%).

Furthermore, it is logical that small and medium-sized companies, most of which have contracts for shorter periods of time than large companies, are more likely to increase prices. On average, industrial output prices will rise by 9%, while large will beable to increase prices less than small and medium-sized firms (8% vs. 10% increase).

The outcome of the recent turbulent times is that the extent to which manufacturing firms will invest in innovation in the coming year varies widely. Half of CEOs (47%) confirm the importance of the fact that, without investment, Czech industry will stagnate. In particular, small and medium-sized enterprises (58%) plan to invest more, compared to one third (35%) of large companies. Two-fifths of companies (42%) will not invest more next year. Stagnation is reported especially by large corporations (52%). A tenth of firms (11%) even admit to a reduction in their investment activity.